What to Do If Insurance Company is Stalling, document all communications and consider seeking legal advice. Contact your state’s insurance commissioner’s office to report the issue.

Dealing with a stalling insurance company can be both frustrating and intimidating. To navigate this process, it’s essential to stay calm and organized. Keeping meticulous records of all interactions, including phone calls, emails, and any mail correspondence, is crucial. Equipped with this evidence, you can build a strong case to challenge unjust delays.

It’s important to remember that insurance companies are regulated at the state level, and each state has a commissioner or an equivalent authority that oversees insurance practices. Notifying this office can put additional pressure on the insurer to resolve your claim more promptly. In cases where the stalling seems deliberate or borders on acting in bad faith, seeking assistance from a legal professional can provide the leverage needed to move your claim forward. With these strategies, policyholders can assert their rights and push for a fair and timely resolution to their insurance claims. [What to Do If Insurance Company is Stalling.]

Credit: www.wildapricot.com

Introduction To Insurance Stalling

Dealing with insurance companies can sometimes lead to an unexpected and stressful hurdle: stalling.

Policyholders trust insurers to act promptly, but when delays occur, they must recognize the signs and

understand the impact. This guide throws light on what to do if an insurance company drags its feet.

Recognizing Delay Tactics

Knowing the signs of stalling tactics by insurers is crucial. Common red flags include:

- Frequent requests for unnecessary paperwork

- Repeated excuses for not processing claims

- Lack of clear communication; no updates provided

- Extended periods without any meaningful action

Timely identification of these tactics empowers policyholders to take necessary steps.

Impact Of Stalling On Policyholders

Delayed responses can cause significant stress. Effects include:

- Financial strain from unpaid claims

- Emotional distress due to uncertain outcomes

- Wasted time battling for rightful compensation

Understanding the implications helps policyholders seek fair resolutions more actively.

Common Stalling Strategies Employed

Dealing with an insurance company can be stressful. Insurance companies sometimes use stalling tactics to delay or reduce payment. Recognizing these strategies can help you take action.

Frequent Request For Additional Information

Insurance providers may repeatedly ask for more documents. This tactic can confuse policyholders. The key is to respond promptly while keeping records of all communications.

- Ensure all responses are complete and timely.

- Keep a detailed log of requests and submissions.

- Ask for a list of all required information at once if possible.

Unjustified Delays In Communication

Long periods with no updates are a red flag. Regular follow-ups on your claim are crucial. Document all attempts to contact the insurer. [What to Do If Insurance Company is Stalling.]

| Action | Expected Response Time | Actual Response Time |

|---|---|---|

| Email sent | 48 hours | Record here |

| Phone call | 24 hours | Record here |

| Document submission | 5 business days | Record here |

- Maintain a record of all dates and times for communications.

- Be proactive. If you don’t hear back, reach out again.

Why Insurance Companies Stall

Dealing with an insurance claim can sometimes feel like a game of patience. Understanding why insurance companies might stall can empower you to navigate the process with confidence. Let’s explore some tactics insurers use and why they might not be rushing to settle your claim.

Financial Benefits Of Delayed Payouts

At the heart of the stalling strategy might be the insurance company’s financial interest. Delaying the settlement process can lead to several benefits for the insurer:

- Investment Income: The longer an insurer keeps funds, the more they can earn through investments. This could be a strong motive for stalling.

- Improved Cash Flow: Delaying payouts helps maintain a healthy cash flow, which is critical for day-to-day operations.

- Claim Abandonment: In some cases, prolonged processes lead to claimants giving up on the claim, reducing the insurer’s payout.

Using Time As A Negotiation Tool

Another common reason for stalling is using time as leverage in negotiations. Here’s how insurers use time to their advantage: [What to Do If Insurance Company is Stalling.]

- Testing Patience: Insurers know that claimants can become desperate over time, potentially settling for less than the claim is worth.

- Collecting More Information: A stalling tactic can also serve as a period for insurers to gather additional evidence that may reduce their liability.

- Legal Advantage: Time can benefit insurers legally, as claimants may miss critical deadlines for filing lawsuits while waiting.

Your Rights As A Policyholder

When you purchase an insurance policy, you are not just buying a safety net. You are entering into a contract. A contract that comes with rights tailored to protect you. It is key to know these rights. Especially when an insurance company seems to drag its feet. Knowing your position can empower you to act confidently. [What to Do If Insurance Company is Stalling.]

Understanding Policy Terms And Conditions

To enforce your rights, comprehending your insurance policy is crucial. The fine print outlines your coverage scope and company duties. Let’s break it down:

- Look for the declaration page. It summarizes coverage, limits, and more.

- Inspect the insuring agreement. It tells what is covered.

- Examine exclusions and conditions. Knowing these helps avoid surprise claim denials.

Doubts or questions? Reach out to your insurer. Clarity can drive action if delays occur.

Legal Protections Against Bad Faith Practices

Your policy is a promise, and the law upholds that. Here are legal staples you should know:

| Right | Description |

|---|---|

| Prompt Communication | Insurers must acknowledge and act swiftly upon claims. |

| Fair Treatment | You merit unbiased claim investigation. |

| Clear Information | Insurance companies should explain claim decisions. |

If stalling tactics persist, remember: The law can be your ally. For legitimate claims, insurers face consequences for unjust stalls or rejections. Legal advisors can guide you. They ensure companies honor their word. [What to Do If Insurance Company is Stalling.]

Always be proactive. Recognize that your insurance contract guarantees you service. It entitles you to legal safeguards against deliberate slow-walking. Stay informed. Enforce your rights.

Immediate Steps To Counter The Stalling

Immediate Steps to Counter the Stalling can transform a frustrating wait into a proactive strategy when dealing with an insurance company. These initial actions are key to maintaining momentum and asserting your rights. [What to Do If Insurance Company is Stalling.]

Maintaining Detailed Documentation

Record-keeping is your first line of defense. Follow these practices:

- Log all communication with dates, times, and representative names.

- Keep copies of all submitted forms and correspondence.

- Summarize phone conversations in writing immediately.

- Store emails and confirmation receipts.

Escalation To Supervisors Or The Insurance Board

If the stalling continues, escalate the issue:

- Request a talk with a senior manager or supervisor directly.

- Detail your concerns and the impact of the delay.

- File a formal complaint with the state’s Insurance Board.

Persistence is crucial. Keep pushing your case up the chain. This pressure often triggers a more timely response. [What to Do If Insurance Company is Stalling.]

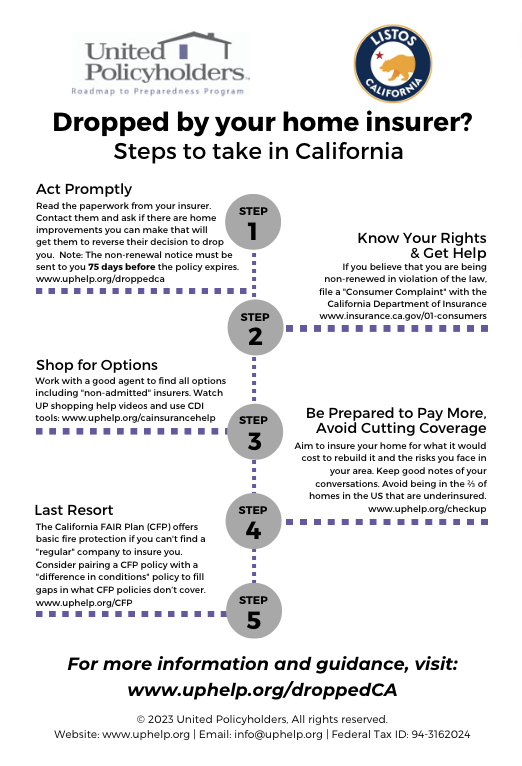

Credit: uphelp.org [What to Do If Insurance Company is Stalling.]

Leveraging Professional Help

Encountering delays with an insurance claim can be frustrating. Knowing when to seek professional help can transform a stalemate into a solution. Let’s delve into the benefits of consulting experts.

Consulting With An Insurance Lawyer

An insurance lawyer steps in when actions stall. Their expertise can expedite claims. They understand the ins and outs of insurance laws. Lawyers will negotiate on your behalf. They ensure you get fair treatment. They can take legal action if needed. Here’s how a lawyer can assist:

- Analyzing your policy for coverage specifics.

- Addressing denied claims or underpayments.

- Communicating directly with the insurance company.

- Representing you in court cases.

The Role Of Insurance Adjusters And Advocates

Insurance adjusters and advocates play critical roles. They act as intermediaries. Advocates focus on your best interests. Adjusters represent insurance firms but must offer fair assessments. Working with these professionals can help clarify misunderstandings. They guide the next steps. Their roles include: [What to Do If Insurance Company is Stalling.]

| Professional | Main Duties |

|---|---|

| Insurance Adjuster |

|

| Insurance Advocate |

|

Negotiation Strategies To Speed Up Resolution

Dealing with an insurance company can be like playing a game of patience, but when you’re waiting for a resolution that seems never to come, it’s time to switch up your strategy. Effective negotiation tactics can prompt quicker action. Learn how to put the ball back in your court with these tips.

Setting Clear Deadlines With The Insurer

Clarity is key in speeding up your insurance claim. Once the ambiguity around timelines vanishes, insurers often respond with increased urgency. [What to Do If Insurance Company is Stalling.]

To set clear deadlines: [What to Do If Insurance Company is Stalling.]

- Review your policy for any mentioned response times.

- Send a formal letter stating when you expect an update or resolution.

- Follow up with a phone call to confirm receipt of your letter.

This approach puts the insurer on notice that you’re monitoring the situation closely, encouraging them to take action to avoid further escalation. [What to Do If Insurance Company is Stalling.]

Utilizing State Departments Of Insurance

If deadlines don’t move the needle, the next step is to get the state involved. Your state’s Department of Insurance can be a valuable ally. [What to Do If Insurance Company is Stalling.]

To engage your state’s department: [What to Do If Insurance Company is Stalling.]

- Locate contact information for your state’s department online.

- File a formal complaint if the insurer continues to stall.

- Provide detailed documentation of your attempts to resolve the claim.

An official complaint often prompts a more diligent response from the insurer.

Credit: nursinghometruth.com

When To Take Legal Action

Dealing with a stalling insurance company can be frustrating. It is crucial to know when to step up the pressure and consider taking legal action. Understanding when litigation is appropriate is key to successfully resolving insurance disputes.

Identifying The Threshold For Litigation

Recognizing the moment to transition from negotiations to legal action is critical. Below are signs that litigation may be needed: [What to Do If Insurance Company is Stalling.]

- Repeated delays in communication or decisions from the insurance company.

- A clear refusal to pay a legitimate claim.

- Low settlement offers that do not cover your expenses.

When these actions become a pattern, it’s time to consider your legal options. An attorney’s advice can be invaluable here. [What to Do If Insurance Company is Stalling.]

The Process Of Initiating A Lawsuit

Starting a lawsuit involves several steps: [What to Do If Insurance Company is Stalling.]

- Documentation: Gather all records related to your claim, including correspondences with the insurer.

- Legal Consultation: Find a lawyer experienced in insurance litigation to assess your case.

- Filing a Complaint: Your attorney will draft and file a legal complaint against the insurer.

- Discovery: Both parties investigate the claims and defenses, exchanging pertinent information.

- Trial or Settlement: The case goes to trial unless a settlement is reached beforehand.

Remember, taking legal action is a serious step. Consulting with an attorney can help clarify the merits of your case. [What to Do If Insurance Company is Stalling.]

Frequently Asked Questions For What To Do If Insurance Company Is Stalling

What To Do If Insurance Company Is Stalling Us?

Contact your insurance company to request an update. Document all communications. Consider consulting with a lawyer if delays persist. Review your policy’s dispute resolution options. File a complaint with your state’s insurance department if necessary.

What To Do If Your Insurance Company Ignores You?

Reach out to your insurance agent for clarification. Document all communications for evidence. Escalate the issue to higher management if unresolved. Consider filing a complaint with your state’s insurance department. Seek legal advice as a last resort.

What To Do When An Insurance Company Is Giving You The Run Around?

Document all communications with your insurer. Insist on written explanations for delays. Consult your policy for dispute resolution options. Reach out to your state’s insurance commissioner. Consider seeking legal advice if issues persist.

What Happens If A Claim Is Taking Too Long?

If your claim processing takes too long, reach out to your insurance provider to inquire about the delay. Consider escalating the issue if there’s no resolution.

Conclusion

Navigating insurance delays can be daunting. Stay proactive and document every step. Don’t hesitate to seek legal counsel if necessary. Remember, persistence and knowledge are your best allies in resolving insurance stall tactics. Keep advocating for a timely and fair response to your claim.

I’m based in the USA, Canada, Australia, and the UK—four vibrant countries with rich educational landscapes and diverse news ecosystems.

Feel free to adjust and personalize this introduction to reflect your unique voice and experiences. Happy writing! 📝✨