Increase Insurance Agent Productivity, streamline processes, and leverage technology. Invest in training and set clear goals for maximum efficiency.

Insurance agents are the linchpin of the industry, directly affecting customer satisfaction and business revenue. Boosting their productivity can significantly impact a firm’s success. Today’s fast-paced market demands efficiency, and insurance companies need to optimize their workforce’s performance. Agents juggle numerous tasks—client meetings, policy explanations, and data management—all of which require a systematic approach to handle effectively.

When insurance companies provide their agents with the right tools and a supportive environment, they pave the way for increased productivity and improved client service. The key lies in identifying areas where agents spend the most time and addressing those with targeted solutions. The introduction of innovative technologies, ongoing educational opportunities, and clear, achievable targets can lead to a more productive agency workforce, ensuring both employee satisfaction and customer loyalty. [Increase Insurance Agent Productivity.]

Introduction To Insurance Agent Productivity

In the fast-paced world of insurance sales, productivity reigns supreme. Efficient insurance agents secure more deals while providing exceptional service.

The Importance Of Productivity In Insurance Sales

Productivity is the heartbeat of successful insurance sales. High productivity levels can lead to a significant increase in revenue as well as a sturdy client base. An agent who maximizes their output often finds greater career satisfaction and advancement opportunities. Focusing on productivity, therefore, is not just about working harder, but working smarter.

Challenges Faced By Today’s Insurance Agents

Insurance agents navigate a complex landscape of challenges that can impede productivity. They face stiff competition, ever-changing regulations, and high customer expectations. Today’s insurance landscape demands that agents are not only knowledgeable but also adept at managing their time and resources efficiently. [Increase Insurance Agent Productivity.]

Common Challenges Include:

- Time Management: Juggling various tasks can be overwhelming.

- Client Expectations: Clients demand quick, personalized service.

- Technological Adaptation: Keeping up with the latest tools requires constant learning.

- Regulatory Compliance: Navigating the ever-changing legal environment takes effort and precision. [Increase Insurance Agent Productivity.]

To combat these challenges, consistent and strategic action is required. An agent’s ability to remain productive directly impacts their success and the satisfaction of their clientele. Employing the right strategies and tools becomes essential for achieving optimal productivity levels.

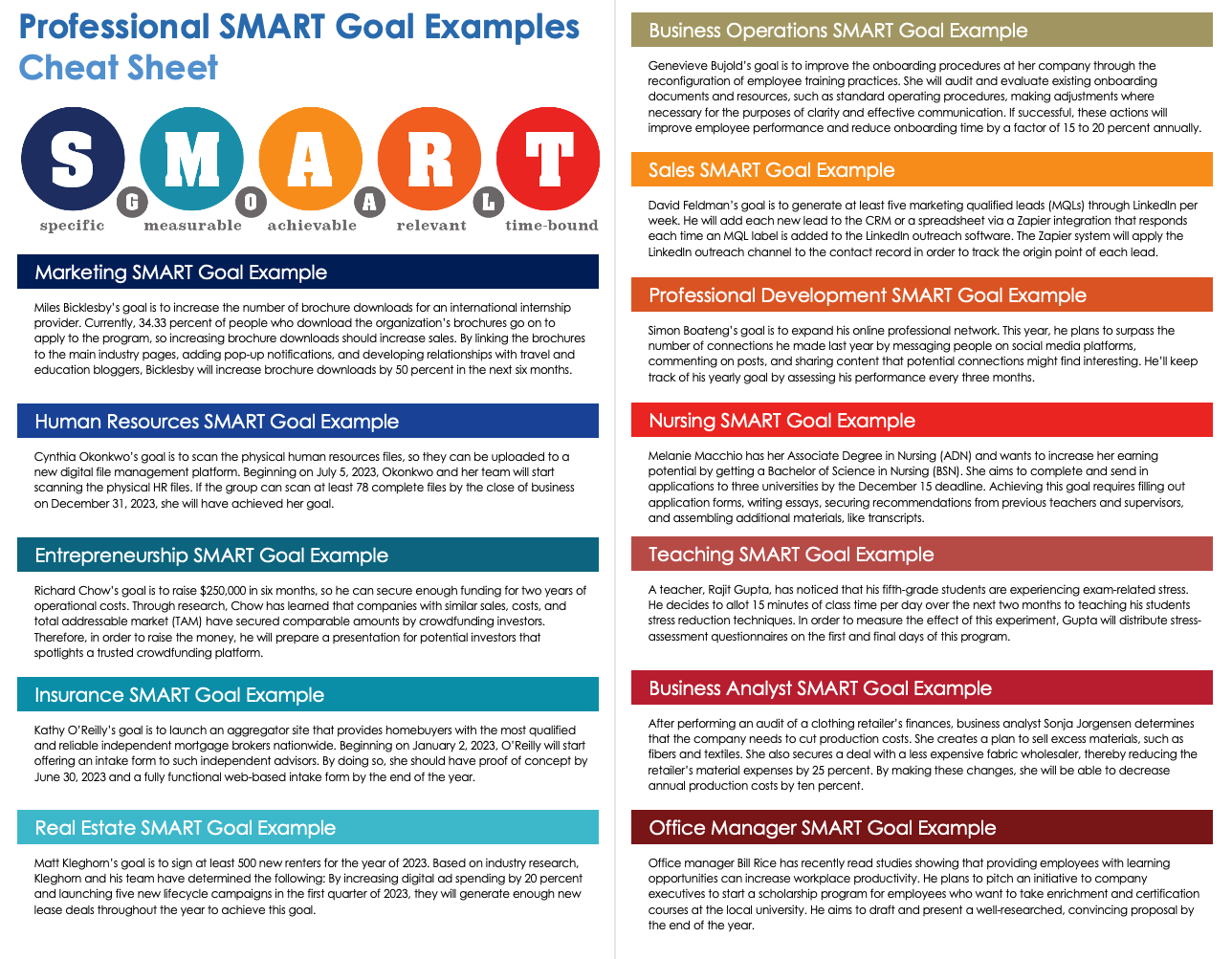

Credit: www.smartsheet.com [Increase Insurance Agent Productivity.]

Leveraging Technology For Efficiency

In today’s fast-paced digital world, insurance agents must embrace technology to stay ahead. Tools that simplify tasks can skyrocket productivity and provide a more seamless customer experience. With the right tech, agents can focus on what matters—building relationships and closing sales.

CRM: Centralizing Customer Information

Customer Relationship Management (CRM) systems are game-changers for insurance agents. They bring together customer data in one place. This means less time searching for information, and more time selling policies. [Increase Insurance Agent Productivity.]

- Simplified data access

- Enhanced customer profiling

- Better lead management

Agencies can understand clients’ needs and tailor communication effectively with a robust CRM system. [Increase Insurance Agent Productivity.]

Automation Tools To Reduce Repetitive Tasks

To boost efficiency, agents can use automation tools. These tools cut down on repetitive, manual work. Agents get more time for important tasks that grow their business. [Increase Insurance Agent Productivity.]

| Task | Tool |

|---|---|

| Email follow-ups | Autoresponder |

| Scheduling appointments | Online calendars |

| Updating records | Data entry software |

Choose tools that integrate with existing systems for a seamless workflow.

Time Management Fundamentals

Exceptional time management transforms good insurance agents into great ones. By mastering the art of organizing daily tasks, insurance professionals can serve clients more effectively and close deals faster. Focusing on core fundamentals of time management ensures that every minute of the workday counts towards greater productivity and success. [Increase Insurance Agent Productivity.]

Prioritizing Tasks For Optimal Workflow

To enhance workflow, agents must identify what’s most urgent. List down activities according to their importance. Apply the Eisenhower Matrix, separating tasks into four categories:

- Urgent and important: Do these first

- Important but not urgent: Decide when to do them

- Urgent but not important: Delegate if possible

- Neither urgent nor important: Drop or delay these

Use color-coded labels or digital tools to visualize priorities. This clarity ensures the right tasks get attention at the right time. [Increase Insurance Agent Productivity.]

Effective Scheduling And Calendar Management

Control time by mastering the calendar. Break the day into blocks dedicated to specific tasks. During these blocks, focus on nothing else. A digital calendar app makes this process simpler. For instance:

| Time Block | Activity |

|---|---|

| 9 AM – 11 AM | Client Meetings |

| 11 AM – 12 PM | Follow-ups & Emails |

| 1 PM – 3 PM | Policy Review |

| 3 PM – 5 PM | New Client Research |

Integrate reminders and set aside time for unexpected tasks. Regularly review your schedule to adjust as needed.

Credit: www.frontiersin.org

Enhancing Communication Skills

Strong communication skills are vital for an insurance agent’s productivity. To build better relationships and close more deals, effective communication is key. Focusing on these skills can lead to more successful outcomes and satisfied clients. Let’s delve into how insurance agents can boost productivity by enhancing their communication abilities. [Increase Insurance Agent Productivity.]

Active Listening And Engagement Techniques

Active listening is a critical component of effective communication. It ensures clients feel heard and understood. Engagement techniques can also improve interaction with clients. Below are strategies to enhance listening and engagement: [Increase Insurance Agent Productivity.]

- Maintain eye contact: Shows attention and interest.

- Nod and acknowledge: Confirms understanding without interrupting.

- Repeat back: Clarifies and verifies client’s points.

- Ask open-ended questions: Encourages deeper conversation.

- Summarize conversations: Ensures both parties are on the same page.

Clear And Persuasive Messaging

Conveying messages with clarity and persuasion is crucial for sealing deals. Here’s how agents can refine their messaging: [Increase Insurance Agent Productivity.]

- Use simple language: Makes the message easily understandable.

- Structure arguments logically: Enhances persuasiveness.

- Highlight benefits: Focuses on what’s in it for the client.

- Be concise: Keeps client’s interest.

- Employ storytelling: Makes the message relatable.

By adopting these methods, insurance agents can boost their productivity through enhanced communication skills. [Increase Insurance Agent Productivity.]

Setting And Tracking Goals

Goal setting and tracking are crucial for any insurance agent looking to boost their productivity. These techniques provide a clear roadmap to success. Agents can visualize their journey and celebrate milestones along the way. [Increase Insurance Agent Productivity.]

Subheading 1: Establishing Realistic Sales Targets

Establishing Realistic Sales Targets

Setting achievable sales targets is the first step to elevating productivity. It’s important to assess both past performance and market conditions. This approach ensures that goals are challenging yet attainable.

Factors to consider include:

- Previous sales data

- Competitive analysis

- Growth objectives

Subheading 2: Using Metrics to Monitor Progress

Using Metrics To Monitor Progress

Keeping track of progress with key metrics is essential. It highlights areas of success and opportunities for improvement. Regular monitoring keeps agents aligned with their goals.

| Metric | Goal | Timeframe |

|---|---|---|

| Number of Calls | Increase by 20% | Quarterly |

| Conversion Rate | Improve by 5% | Monthly |

| Client Retention | Maintain at 90% | Annually |

Agents create a transparent, measurable path to enhancing productivity by focusing on these areas.

Continuous Learning And Development

Continuous learning and development are vital tools for any insurance agent looking to boost their productivity. Staying ahead in a fast-paced industry means embracing new knowledge and skills.

Embracing Industry Updates And Trends

The insurance sector is always shifting. To ensure agents can give top service and advice, they must stay informed about the latest happenings. [Increase Insurance Agent Productivity.]

- Read industry journals and news regularly.

- Subscribe to newsletters from thought leaders.

- Join webinars for the newest insights.

Investing In Professional Training Programs

Structured education can elevate a career to new heights. Insurance agents should invest in training programs.

| Training Type | Benefits |

|---|---|

| Online Courses | Flexibility and variety of specialized topics |

| Workshops | Interactive learning and networking opportunities |

| Certifications | Improved expertise and credibility |

- Choose programs that align with your career goals.

- Set aside regular time for study and practice.

- Apply new skills to daily tasks for reinforcement.

Streamlining Administrative Tasks

To ramp up the efficiency of insurance agents, it’s crucial to streamline administrative chores. These tasks can take up a significant chunk of the day. Hence, refining these processes is pivotal for productivity. Improved systems allow agents to spend more time with clients. Resulting in a positive spiral of increased sales and job satisfaction. [Increase Insurance Agent Productivity.]

Delegating Non-sales Activities

Agents excel when they focus on selling. To boost their productivity, delegate lesser-value tasks. Use resources effectively. Assign administrative duties to support staff. This frees agents to do what they do best – sell insurance.

- Hire administrative help to manage calls and scheduling.

- Utilize virtual assistants for data entry and follow-ups.

- Implement teamwork strategies where junior staff handle preliminary work.

Paperwork Simplification Strategies

Complex paperwork can slow down the momentum of even the most seasoned agents. Simplifying document handling is key to unlocking more time for sales. [Increase Insurance Agent Productivity.]

| Strategy | Benefit |

|---|---|

| Use digital forms | Reduces manual entry and errors |

| Implement e-signatures | Speeds up the document approval process |

| Adopt a CRM system | Keeps client info organized and accessible |

- Introduce document management systems for easy access and organization.

- Set up workflow automation tools to save time on routine tasks.

- Regularly train staff on new technologies and best practices for efficiency.

Fostering A Supportive Team Environment

Fostering a Supportive Team Environment is crucial for boosting the productivity of insurance agents. A workplace where collaboration and support are emphasized encourages agents to perform at their best. Let’s explore how teamwork and a positive environment lead to a more efficient and successful insurance agency.

Collaboration Among Agents

Collaboration unlocks collective wisdom, leading to better outcomes for clients. Agents with diverse expertise can share insights, making problem-solving faster and more effective. Here’s how to encourage collaboration: [Increase Insurance Agent Productivity.]

- Weekly team meetings to discuss challenges and strategies.

- Mentorship programs pairing experienced agents with newcomers.

- Using communication tools like Slack or Microsoft Teams for seamless interaction.

- Creating a central knowledge base where agents can access and contribute helpful resources.

Celebrating Successes And Learning From Failures

Recognition and reflection are key to an effective team. Celebrating successes boosts morale, while learning from failures fosters resilience and growth. To implement this practice:

| Action | Benefit |

|---|---|

| Awards for top performers | Motivates agents to strive for excellence. |

| Constructive feedback sessions | Encourages continuous skill improvement. |

Remember to keep feedback positive and solutions-focused. This will help the team develop a mindset that views challenges as opportunities for development.

Incorporating Wellness Into The Workday

A productive insurance agent is often a well-balanced one. It’s not just about the number of calls or meetings in a day. Wellness plays a huge part. When agents feel good, they work better. A focus on wellness can mean less stress and a better work-life balance. Agents get more done and feel happier doing it. Let’s explore some key strategies. [Increase Insurance Agent Productivity.]

Stress Management Practices

First, we tackle stress. Too much can hurt work success. Regular breaks are important. These may include: [Increase Insurance Agent Productivity.]

-

- Deep breathing exercises to calm the mind.

- Quick walks to reset the body’s stress levels.

- Mindfulness apps, are easy to use at a desk or on the go.

Also, regular team-building activities can ease stress. These promote a supportive work culture. Desk stretches and relaxation techniques also help. A simple five-minute stretch can offer a fresh perspective. [Increase Insurance Agent Productivity.]

Balancing Work And Personal Life

Balance is key for sustained productivity. Here are ways agents can achieve this:

| Strategy | Benefits |

|---|---|

| Set boundaries | Reduces burnout risks. |

| Flexible schedules | Allows for personal time during the day. |

| Time off | Restores energy and focus. |

| Prioritize tasks | Keeps important work in focus. |

Encourage agents to use their vacation time. It’s there for a reason. A well-rested agent is an effective one. Short, regular breaks during the day also help. They can prevent burnout. Agents should feel comfortable managing their schedules. This includes personal appointments or family time.

Remember, a happy agent brings in happy customers. Focus on wellness to boost success in the workplace. [Increase Insurance Agent Productivity.]

Credit: www.iovox.com

Strategic Client Relationship Management

Strategic Client Relationship Management forms the backbone of insurance agent productivity. Building a robust connection with clients not only boosts trust. It also drives business growth. A strategic approach focuses on understanding each client’s unique needs. It tailors services to match.

Personalizing Client Interactions

Exceptional client experiences stem from personalized interactions. Each conversation should make the client feel valued. Use available data to understand client preferences. Tailor communication styles accordingly. Personal touchpoints can include: [Increase Insurance Agent Productivity.]

- Custom Emails: Address clients by name. Reflect on their interests and past interactions.

- Birthday Wishes: Send notes or emails on special occasions to show you care.

- Targeted Advice: Offer insights tailored to clients’ specific situations or goals.

Remember to use client information responsibly, keeping data security in mind.

Cultivating Long-term Client Loyalty

To boost lifetime value, long-term loyalty is key. Show clients their long-term benefits. Provide consistent value. Regular check-ins help maintain rapport. Quality service encourages referrals and sustaining growth. Steps to foster loyalty include:

- Regular Reviews: Schedule annual reviews to discuss coverage needs and changes.

- Value-Added Content: Send newsletters with insights that benefit clients.

- Loyalty Programs: Reward clients for referrals and continued business.

These strategies ensure clients remain engaged and satisfied with your services.

Adopting A Client-centric Approach

Boosting productivity as an insurance agent hinges upon putting clients first. A client-centric focus tailors the insurance experience. Agents become more effective. They address distinct customer needs. Positive outcomes grow with satisfied clients. Explore how understanding your client and customizing solutions can elevate productivity. [Increase Insurance Agent Productivity.]

Understanding Client Needs

Grasping what clients truly want is the first step. Thriving agents ask the right questions. Listen closely to their concerns. They dig deeper than surface needs. Building trust is key. Effective use of client surveys can unveil specific needs. Use tools like CRM systems to maintain detailed client profiles. These steps ensure that no detail goes unnoticed.

- Conduct surveys regularly to get fresh insights.

- Use CRM to track changes in client needs.

- Review profiles before meetings for a personalized touch.

Customizing Insurance Solutions

Each client deserves a unique solution. One size does not fit all in insurance. Tailored plans reflect an understanding of individual needs. They also show dedication to providing exceptional service. Effective agents combine different policies to suit varied lifestyles. Pivot quickly with flexible offerings. Use clear communication to explain how these customized options benefit clients.

| Client Profile | Needs | Customized Solution |

|---|---|---|

| Young Families | Security, Education, Health | Mixed life and health insurance packages |

| Business Owners | Asset Protection, Liability | Comprehensive business insurance plans |

Remember, productivity is not just about doing more. It’s about doing what matters most. A client-centric approach can redefine your productivity journey. Understand deeply. Customize wisely. Thrive as an insurance agent. [Increase Insurance Agent Productivity.]

Innovations In Insurance Selling

The world of insurance selling is rapidly changing. A fresh wave of innovations is paving the way for insurance agents to work smarter, not harder. Embracing new methods and tools is no longer optional, but a necessity for those aiming to stay ahead of the curve and boost their productivity.

Exploring New Insurance Products

Creative insurance solutions are entering the market. Agents should become well-versed in these offerings. This will allow them to match unique client needs with the perfect policy. Let’s delve into a few ways agents can benefit from these products: [Increase Insurance Agent Productivity.]

- Meeting unique customer demands with tailor-made insurance policies.

- Staying on top of market trends to provide the latest coverage options.

- Expanding target markets by offering new products to different demographics.

Harnessing Data Analytics For Enhanced Sales Strategies

The power of data analytics cannot be underestimated in the modern insurance landscape. By analyzing customer behavior and market statistics, agents can refine their sales strategies. Here are key insights into harnessing data analytics:

| Strategy | Benefits |

|---|---|

| Predictive analytics | Anticipate customer needs, boosting the relevance of pitches. |

| Customer segmentation | Customize communication, resulting in higher engagement rates. |

| Trend analysis | Keep ahead of industry shifts, positioning agents as authorities. |

Conclusion: Maximizing Insurance Agent Effectiveness

Increasing productivity is vital for insurance agents aiming for peak performance. An effective agent can provide better customer experiences and drive more sales. This section wraps up key strategies to propel insurance agents toward optimal productivity.

Summary Of Key Productivity Strategies

An array of productivity strategies can reshape the workday for insurance agents. A quick recap of what we covered: [Increase Insurance Agent Productivity.]

- Time Management: Agents must prioritize tasks and manage their calendars wisely.

- Tech Adoption: Utilizing CRM systems and automation tools streamlines processes.

- Training and Skills: Regular training sessions ensure agents are up to speed with the latest industry trends.

- Goal Setting: Establishing clear, measurable goals provides agents with direction and motivation.

- Healthy Work-Life Balance: Productivity soars when agents are well-rested and stress-free. Encouraging a balanced lifestyle is key.

Committing To Continuous Improvement

Mastering productivity is an ongoing journey. Agents should embrace a growth mindset, seeking constant improvement in their strategies. This involves: [Increase Insurance Agent Productivity.]

- Regular feedback and reviews to identify areas for personal development.

- Being open to new learning opportunities and resources.

- Adapting practices based on insights from client interactions and outcomes.

By focusing on these points, agents can ensure their growth never plateaus.

marketing ideas for insurance agency

For an insurance agency looking to boost its marketing efforts, several innovative ideas can help attract new clients and retain existing ones. Firstly, leveraging social media platforms like Facebook, Instagram, and LinkedIn can be highly effective in reaching a broader audience.

Creating engaging content, such as informative blog posts, educational videos, and client testimonials, can establish the agency as a trusted resource in the insurance industry.

Additionally, hosting webinars or virtual events on topics relevant to insurance coverage can attract prospects and showcase the agency’s expertise. Partnering with local businesses or organizations for cross-promotional opportunities and attending community events can also increase visibility and credibility. [Increase Insurance Agent Productivity.]

Offering incentives like referral bonuses or discounted premiums for loyal customers can incentivize client retention and word-of-mouth referrals. Finally, investing in search engine optimization (SEO) to improve the agency’s online visibility and reputation management to monitor and respond to client reviews can further enhance its marketing strategy.

By implementing these creative marketing ideas, an insurance agency can effectively differentiate itself in a competitive market and drive growth. [Increase Insurance Agent Productivity.]

Frequently Asked Questions For How To Increase Insurance Agent Productivity

How Do I Become A Productive Insurance Agent?

To become a productive insurance agent, gain deep knowledge of insurance products, excel in customer service, harness the power of networking, embrace continuous learning, and effectively use CRM tools to manage clients and prospects.

Why Do So Many Insurance Agents Fail?

Many insurance agents fail due to inadequate training, poor sales skills, a lack of persistence, insufficient networking, and unrealistic expectations about effort and income.

How Can I Maximize My Insurance Sales?

To maximize insurance sales, develop strong client relationships, offer personalized solutions, utilize social media marketing, nurture leads with email campaigns, and consistently deliver exceptional service. [Increase Insurance Agent Productivity.]

Why I Quit Being An Insurance Agent?

I quit being an insurance agent due to high stress levels, the constant need for sales, and a desire for a better work-life balance. My career goals shifted, and I sought a profession with more personal fulfillment.

Conclusion

Enhancing insurance agent productivity is essential for a thriving agency. Embrace technology, refine your workflows, and prioritize ongoing training. Remember, small steps can lead to significant gains. By implementing these strategies, agents can achieve greater efficiency, improved client relations, and increased sales.

Begin this transformation now and witness a measurable uptick in productivity.

I’m based in the USA, Canada, Australia, and the UK—four vibrant countries with rich educational landscapes and diverse news ecosystems.

Feel free to adjust and personalize this introduction to reflect your unique voice and experiences. Happy writing! 📝✨